what months are property taxes due

The final Texas property tax due date is January 31st every year. For now the September 1 deadline for the second installment of property taxes will remain unchanged.

Ontario Property Tax Rates Calculator Wowa Ca

Will County property tax due dates 2021.

. Payments are due as follows. Are Illinois property taxes extended. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill.

For secured property taxes the first installment is due November 1 and delinquent after December 10 and the second installment is due on February 1 and delinquent after April 10. The taxes are due by the following March 31. Ask Your Own CA Real Estate Question.

In most counties property taxes are paid in two installments usually June 1 and September 1. If they are not paid by December 10th they. You either pay your property taxes two or four times a year depending on the propertys assessed value.

July 1 October 1 January 1 and April 1. What months are property taxes due. This calendar will be posted to the.

2020 PROPERTY TAX CALENDAR. The bills are sent 30 days before they are due. Open All Close All January February March April May June July August September October November December In practically all cases the action may be done before the specified date.

Bills are generally mailed and posted on our website about a month before your taxes are due. This website provides current year unsecured tax information and is available between March 1 and June 30 only. MARCH 1 Annual mailing of personal property tax bills begins.

FEBRUARY 15 Deadline for filing homeowners exemption claim 7000 assessment. What months are real estate taxes due. The LTA for Property Tax Calendar 2022 is No.

Property taxes are due in two installments about three months apart although there is nothing wrong with paying the entire bill at the first installment. Customer reply replied 3 years ago. Each year the Property Tax Calendar is announced via a Letter To Assessors LTA.

Current property tax due dates are. Hill Street Los Angeles CA 90012. Property Tax Due Dates Property Tax Bills Property tax bills commonly called tickets are issued on or after July 15 of the property tax year by county sheriffs for all property except public utility operating property.

Other Relevant Texas Property Tax Due Dates. October purchases must be paid by November 30 while November purchases have a due date of December 31. Download Your Property Tax Bill.

Ad Free Online Tax Tutorial - Tax Consultant Certification - Be Certified Tax Consultant 100. Find All The Record Information You Need Here. When are property tax due in California.

Enter Any Address Receive a Comprehensive Property Report. 2019 payable 2020 tax bills are being mailed May 1. So your property tax bills will be mailed four times per year.

APRIL 10 Second installment of real property taxes becomes delinquent after 500 PM. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. What months are property taxes due.

The property is in Los Angeles County City of Compton Ca. Page which may be viewed from the Board of Equalizations website at. Property Tax Calendar If you have questions about any of the dates applications or programs listed below contact your county Assessors office.

Search When Is My Property Tax Due. Half of the First Installment is due by June 3 2021. Ad Search When Is My Property Tax Due.

Enclosed is the 2020 Property Tax Calendar which identifies action and compliance dates of importance to assessing officials and taxpayers. Taxes due for July through December are due November 1st. See Results in Minutes.

In most counties property taxes are paid in two installments usually June 1 and September 1. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. Ad Unsure Of The Value Of Your Property.

Half of the First Installment is due by June 3 2021. Taxes for the months of July through December are due November 1st with a late fee of 10 added if your payment is not postmarked by December 10th. Up to 15 cash back When are property tax due in California.

Public utility property tax bills are issued by the State Auditor in June of the property tax year. Then taxes for January through June are due by February 1st with a late fee of 10 plus. Will County tax bill due dates 2021.

What months are real estate taxes due. Due Dates NYCs Property Tax Fiscal Year is July 1 to June 30. Answered in 31 minutes by.

Technically your property taxes are due as soon as you receive a tax bill. Contact Info Email Contact form Phone 651-556-6922 Hours Address Last Updated August 11 2021. In most communities Valuation Date is July 1 of the prior year.

Municipal County property tax bills Mailed in the beginning of January in most communities Payment deadlines vary in some municipalities and counties Valuation Date Valuation Date is the date upon which the value of your property is based. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. Get Results On Find Info.

Second installment of real estate taxes is due delinquent after 500 PM on April 10. We are located on the first floor in Room 122. Finance mails property tax bills four times a year.

Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022. In most counties property taxes are paid in two installments usually June 1 and September 1. The fiscal year for Santa Clara County Taxes starts July 1st.

Delinquent Unsecured Tax information is only available by telephone or in person. Property Taxes Legal Resources. In most counties property taxes are paid in two installments usually June 1 and September 1.

If you purchase unsecured property in August the due date becomes September 30 delinquency occurs on November 1st. What month are property taxes due. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your.

In most counties property taxes are paid in two installments usually June 1 and September 1. However you have until January 31st to pay without accruing interest fees or penalties. Please call 213893-7935 or visit us at 225 N.

If you purchase in September your due date will be October 30th with a delinquency on November 1. The remaining half of the First Installment is due by August 3 2021.

Property Taxes City Of North Vancouver

Remodeling Custom Homes Siding Roofing General Contractor Home Buying Tips Home Buying Process Home Buying

Property Taxes In Spain 9 Taxes You Have To Know

Is Property Tax Federal Or State Property Tax Finance Guide What Is Property

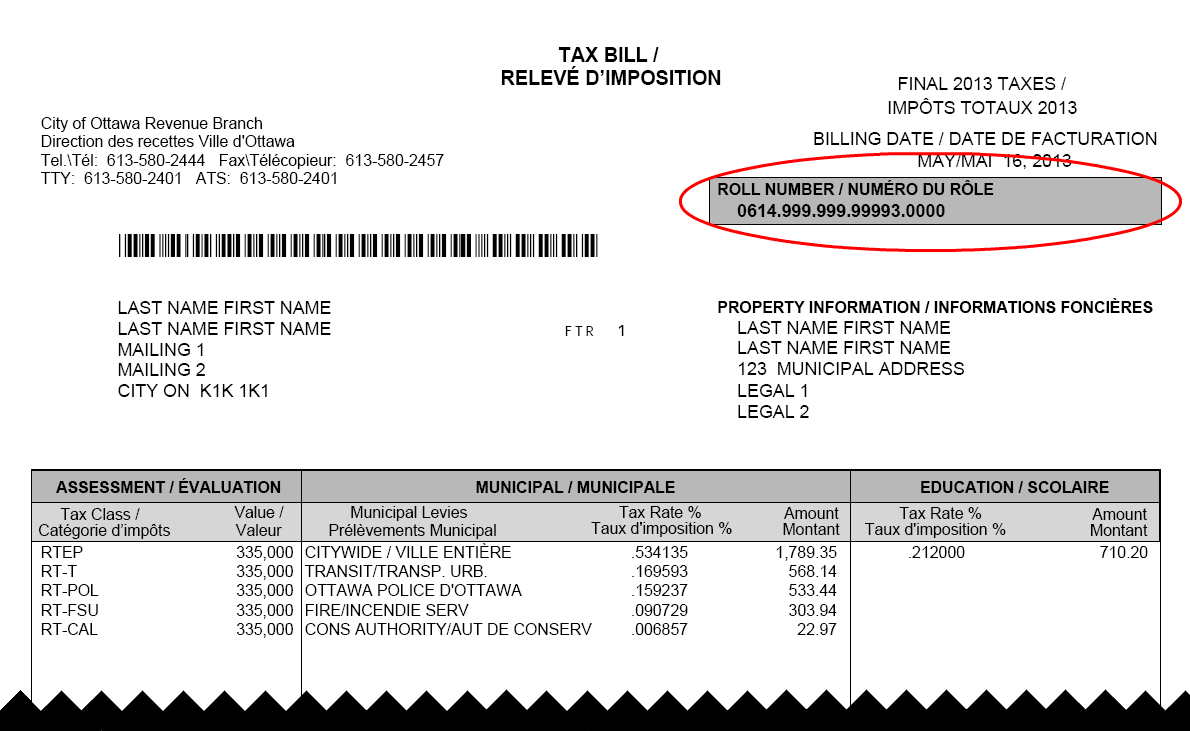

Property Tax Bill City Of Ottawa

Penalty For Filing Taxes Late How To Prevent Internal Revenue Code Simplified

Secured Property Taxes Treasurer Tax Collector

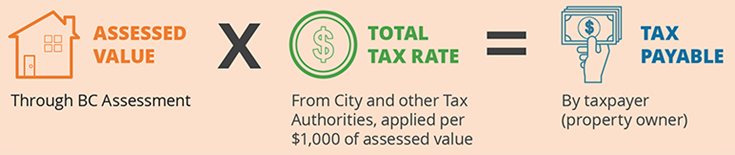

Your Property Tax The City Of Red Deer

Property Taxes City Of North Vancouver

Your Property Tax The City Of Red Deer

Florida Property Tax H R Block

Pune Civic Body Mops Up Rs 1 000 Crore In Property Tax In Five Months Abhousingrealtypvtltd Home Newhome Buyhome Ho Positive Vibes Positivity Property Tax

South Jersey Real Estate Market Has Come Roaring Back In Recent Months Agents Say Real Estate Agency Sell Property Real Estate Services

Property Tax How To Calculate Local Considerations

Westward Group For Tax And Estate Planning Advisors Tokyo Tips Property Taxes In Japan Http Tokyo Angloinfo Com Informatio Estate Planning Advisor Westward